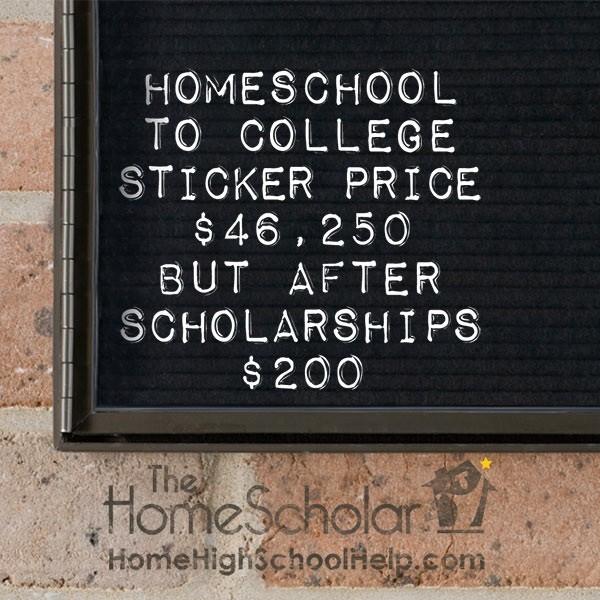

Sticker Price $46,250, but After College Scholarships, Only $200

Published on April 28, 2020 by LeeBinz

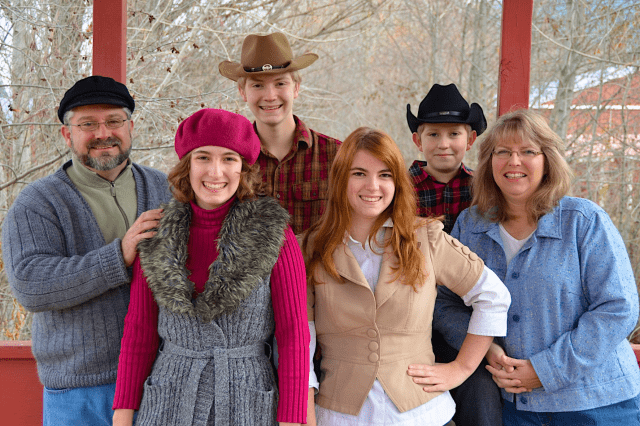

Let’s talk about college scholarships. Every family, that has a child going to college, wants them, but they seem to be so elusive! Let me introduce you to Lin and her family of 6. The family is committed to graduating their children debt-free, and has been using my resources for over 10 year to achieve that goal. Let Lin inspire you and your family that college scholarships are not only possible, but a debt-free college experience is possible!

Learn more about scholarships with my free online, on-demand class, Super Scholarships for Humble Homeschoolers.

by Author

If you’re like Lin and would like to graduate your children from college debt-free by taking advantage of all of the college scholarships possible, read on. Lin wrote with some advice for homeschooling families who are concerned about getting college scholarships, especially since the sticker price for college is so very high!

Dear Lee,

“I have been following and learning from you for years and am now preparing to graduate my 4th and final child. Today, he received his financial aid offer from his first-choice university. Thanks to all I’ve learned from you, the numbers were amazing! Sticker price for one year at this well-respected private university is $46,250. Our cost after college scholarships and grants for this year is $200. This is without even taking into account the additional scholarships he is in the middle of applying for, including one for which he was just named a state finalist.

Some of the most helpful tips from you over the years that have contributed to this result are:

- Start keeping records in middle school (classes, activities, reading lists) – We didn’t know then that we would graduate him as a junior, but we had the records we needed when we made that decision several years later.

- Don’t wait until senior year to research scholarships – Several thousand dollars of his college scholarships are from something he signed up for in middle school.

- Find which high school test works best for your child (SAT® or ACT® ), and make time to study for it – His combined ACT® / GPA have been worth a promise of $80,000 ($20,000 per year over 4 years) from this school.

- Visit potential schools early and often – This tip gave us a good idea of the options, got him on their radar, built rapport with the admissions counselor, and resulted in a $1,000 visit scholarship.

- Get your admission application in early (i.e. September) – this got him an early decision, took the pressure off as he was starting dual enrollment, and allowed him to turn his focus to getting scholarships.

- Get your FAFSA® done in October – Because we filled out FAFSA® early, he was first in line for generous federal, state, and institutional income-based aid.

- Don’t let the sticker price of a private university dissuade you from applying – The cost may appear high, but the financial aid may be more generous than a state school.

- Eldest daughter – 2 classes away from graduating college

- Eldest son – 3/5ths through his program

- Youngest daughter – BA done, currently at a 1-year Bible program

- Youngest son – over $100,000 in scholarships in hand so far

- Husband in seminary – halfway through his program debt-free

DEBT FREE!!!!! Coverage of all future expenses is uncertain, but we are thankful for all the help you’ve provided in the past.

Thanks, as well, for preparing me for my current job! As I was on the tail end of my homeschooling career a year ago, I learned of a job opening at a local college. I realized they just needed someone to do for all their students what I was already doing administrating my home school:

- Figuring out different ways to satisfy program requirements

- FAFSA® and Scholarship hunts

- Keeping track of who is where in the program

Thanks again for the blessing you’ve been! Kinda sad that I’m moving on now that my youngest is graduating.”

~ Lin

Do you need scholarships too? All those helpful tips that Lin listed are important. They can be a significant factor in admission and college scholarships. In tip #3 above, Lin mentions finding out which high school test is better for your child. Did you even know that there was a possibility that your child could do better on one test over the other? Have your student practice taking the ACT® & SAT® at home and see which they score better on. That’s a real strategy! Read 6 Top Tips on Tests to learn more about taking high school tests.

You really can help your teens achieve their college dreams debt-free and I’d love to help you! You are your child’s Best High School Counselor!

Like Lin, you can join the Gold Care Club and get support and encouragement with personal email coaching each week. Or if you prefer to learn independently, look at the College Launch Solution for regular monthly assignments provided by coaching emails that will prepare you to successfully launch your teen into college and life.

SAT®, AP®, and CLEP® are trademarks owned by the College Board, which is not affiliated with, and does not endorse, this blog post or The HomeScholar, LLC.

FAFSA® is a registered trademark of the U.S. Department of Education