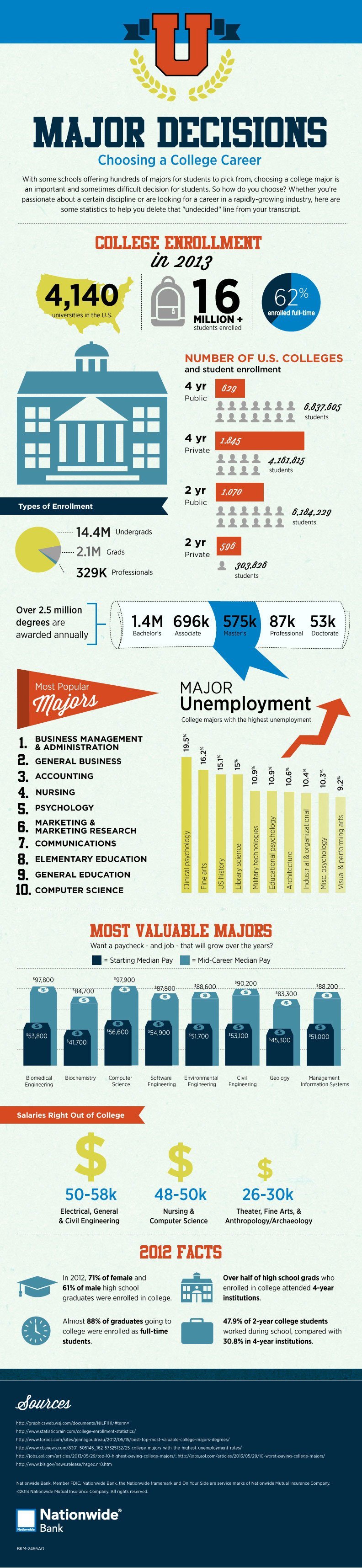

College Cost Infographic

Published on February 3, 2014 by LeeBinz

This infographic has some interesting information about college. Scroll down and look at the college majors with the highest unemployment. Compare that to the starting pay for some of those college majors. These are good details to know when you are looking at the cost of college.

Will your child get a job?

Can your child earn enough to pay off college debt?

Our children don’t always understand the long-term consequences of college debt, and we need to help them think it through. What will the consequences be? How long will it take to pay off the loans? Whether the debt is carried by the parent or the student, it’s helpful to guide their decisions.

I suggest a general rule of thumb. If your child could live at home for one year and make enough money at a minimum wage to pay off their college loans within one year, then it might be worth going into debt. Otherwise, think long and hard about the financial consequences. Carrying a higher debt load might be something to consider if you are reasonably certain of a reasonably high salary that you could still pay off within a year of working.

Click on the infographic to see a larger image you can read easily.

Work hard at the college admission process, and you’ll be surprised at how affordable college can be. Sure, it’s often expensive, like a car is expensive, but you can get a good price that you can afford. Check out my book on College Admission and Scholarships from Amazon.